Introduction

In the world of forex trading, the use of automated trading robots is becoming increasingly popular. They provide traders with the ability to automate their trading strategies and manage their trades 24/7. In this article, we will look at the features of an automated trading robot for the MetaTrader 4 (MT4) platform.

The MT4 Automated Trading Robot, or Expert Advisor (EA), is a specialized software that was created to automate trading operations on the MetaTrader 4 platform. EA uses predefined trading algorithms and rules to analyze market data in real time and make decisions on opening or closing trading positions without direct trader involvement.

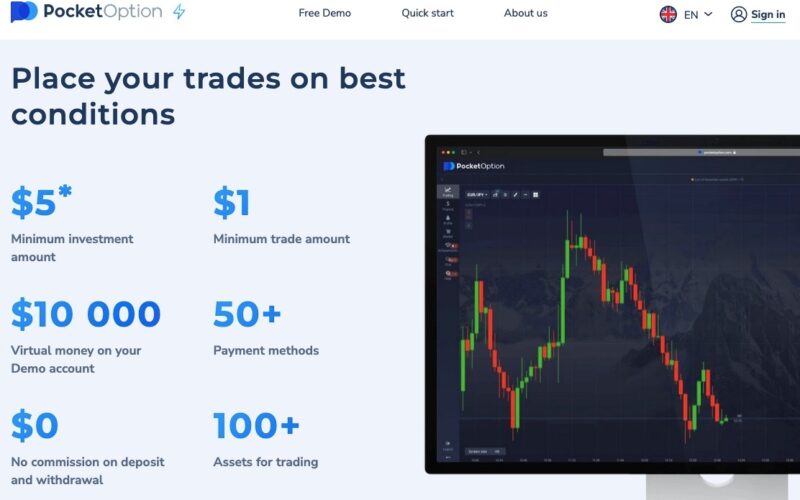

This approach minimizes the impact of emotions and errors on the trading process, and allows trading around the clock, even when the trader is unavailable. Robots can be customized to execute a wide range of strategies and techniques, from simple operations based on technical analysis to more complex algorithmic strategies. To get started with MT4, you can find a forex broker that supports working with it, for example, traders consider Pocket Option – https://revieweek.com/review/pocketoption/ – to be a reliable broker.

Advantages and Disadvantages of MT4 Automated Trading Robot

Advantages:

- Round-the-clock trading. Robots can trade 24 hours a day, 5 days a week.

- Removal of emotional factor. Trading robots completely remove the emotional element from trading.

- Fast response to market changes. Robots are able to process large amounts of data and react quickly to market changes.

- Time saving. Using robots allows you to save time, as most of the work is automated.

If you’re looking for a cryptocurrency trading robot, consider the following RevenueBOT – https://revieweek.com/review/revenuebot/

Disadvantages of MT4 automated trading robot:

- Although trading robots can operate autonomously, they require constant monitoring and periodic tweaking to maintain effectiveness.

- Trading robots are completely dependent on the quality of the internet connection and the performance of the trading platform. Technical failures may result in lost trading opportunities or losses.

- Robots may not perform effectively in unusual or unexpected market conditions that were not anticipated in their algorithms.

- New or complexly modified robots require thorough testing on a demo account or through a tester strategy before use on a live account.

MT4 Automated Trading Robot: How it Works

An MT4 automated trading robot works based on a predefined algorithm or set of rules that determine its actions. Here is the basic principle of such a robot:

- First, the robot analyzes market data, including prices, technical indicators and other economic indicators, to determine current market conditions.

- The robot then applies predefined trading strategies or algorithms based on this data. These can be simple rules based on certain indicators or complex algorithms that utilize statistical or machine learning.

- If the market data matches the conditions set in the robot’s trading strategy, the robot automatically performs trading operations such as opening, closing, and modifying orders.

- The robot continuously monitors the market and adapts its actions according to changing conditions. If market conditions change in such a way that they no longer match the conditions of the trading strategy, the robot can close open positions and stop new operations.

Conclusions

Despite possible technical problems and the need for regular updates, the MT4 automated trading robot can be a valuable tool in any trader’s arsenal. It allows you to maximize the possibilities of the MT4 platform, facilitates the trading process and helps you trade more objectively and systematically.